Georgia payroll calculator 2023

Web Georgia tax year runs from July 01 the year before to June 30 the current year. Web The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022.

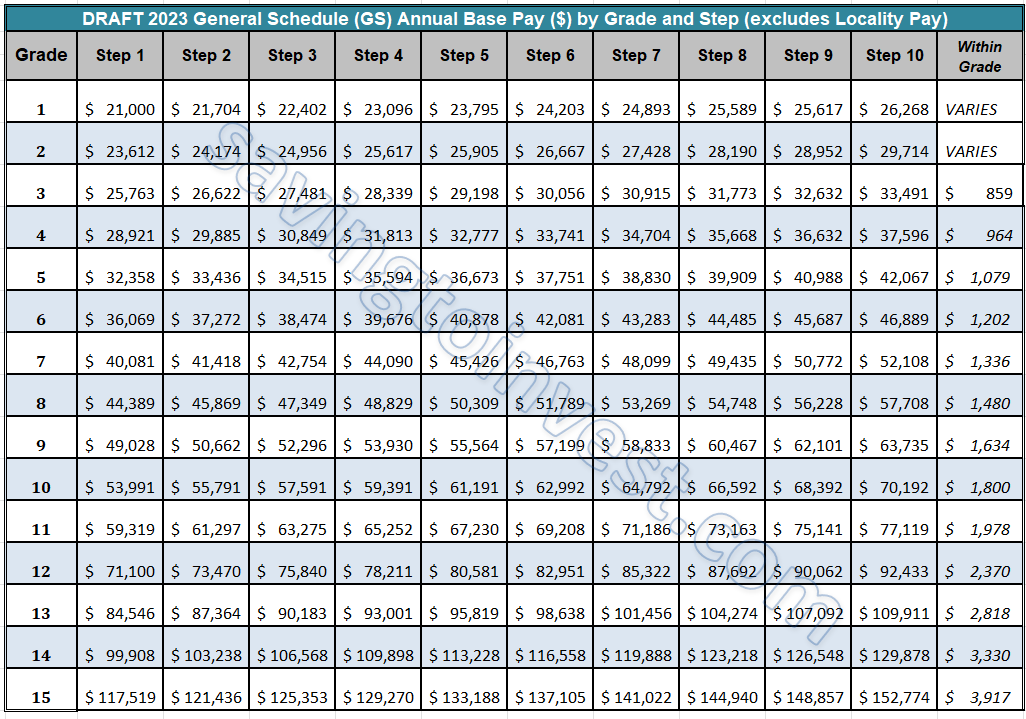

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Web Georgia payroll calculator 2023 Tuesday September 6 2022 Once students are eligible to take major-level Computer Science courses CSC 2720 and 3000- and 4000-level.

. Web So if you earn 1099 per hour your annual salary is 2000000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours. Web Georgia Paycheck Calculator. Web Rest of Georgia Print Locality Adjustment.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. Web News for 2023 GS Pay Scale. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

250 minus 200 50. Web An Iowa paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Skip to main content.

Web For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. Employers have to pay a matching 145 of Medicare tax. Ad Full payment flexibility for your team across 100 currencies and 10 payment methods.

Web That result is the tax withholding amount. 2022 Federal income tax withholding. Heres how you know.

Web Georgia Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Sign up for a free Taxpert account and e-file your returns each year they are due.

This calculator is for 2022 Tax Returns due in 2023. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292.

The payroll tax rate reverted to 545 on 1 July 2022. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance. Why Gusto Payroll and more Payroll.

Web 2022 Federal income tax withholding calculation. Get a head start on your next return. White House Formalizes Average 46 Pay Raise for Federal Employees in 2023 Sept.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Web Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan.

Web Begin tax planning using the 2023 Return Calculator below. Web Important note on the salary paycheck calculator. Web Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay.

Web This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data. An official website of the United States government. Use our employees tax calculator to work out how much PAYE and.

Prepare and e-File your. Web Use this simplified payroll deductions calculator to help you determine your net paycheck. Ad Full payment flexibility for your team across 100 currencies and 10 payment methods.

Web 2022-2023 Online Payroll Tax Deduction Calculator. This Tax Return and Refund Estimator is currently based on. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication.

2 2022 The presidents alternative pay plan is an. Then look at your. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Web Payroll calendars are available for download and print. Simply enter their federal and state W-4.

Any federal employees in Georgia who do not live in an area for which a specific Locality Pay Adjustment has been set will receive.

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2

Eligibility Income Guidelines Georgia Department Of Public Health

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

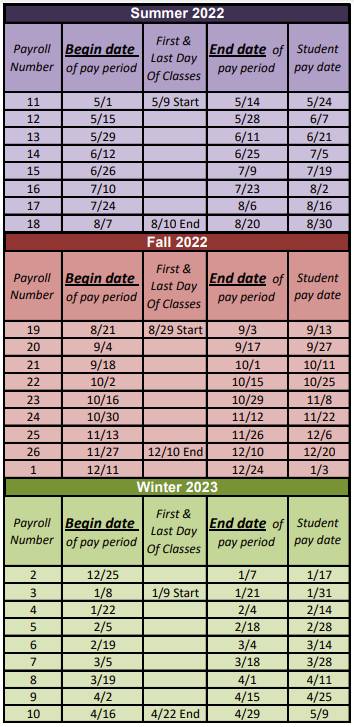

Pay Periods And Pay Dates Student Employment Grand Valley State University

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Estimated Income Tax Payments For 2022 And 2023 Pay Online

2022 2023 Latest Chinese Baby Gender Prediction Calendar Boy Or Girl Youtube In 2022 Baby Gender Prediction Gender Prediction Gender Prediction Calendar

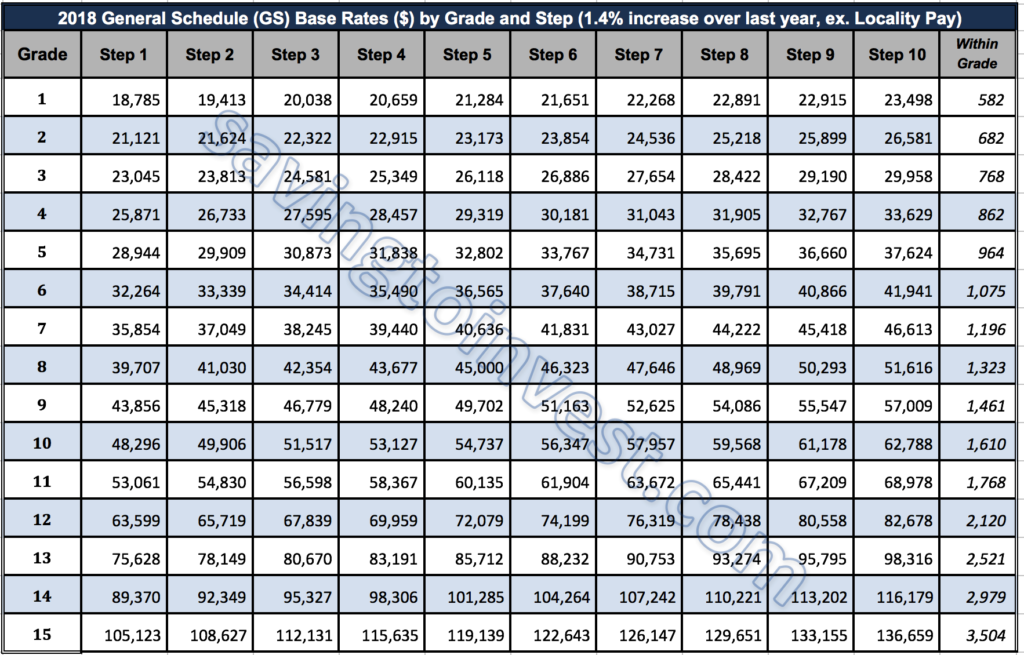

General Schedule Gs Base Pay Scale For 2022

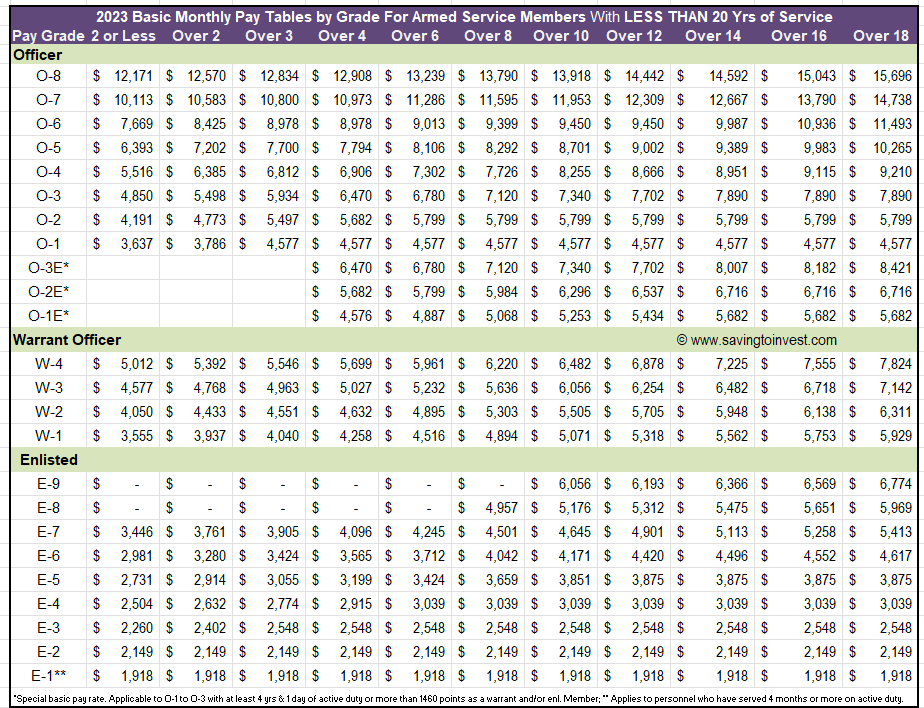

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

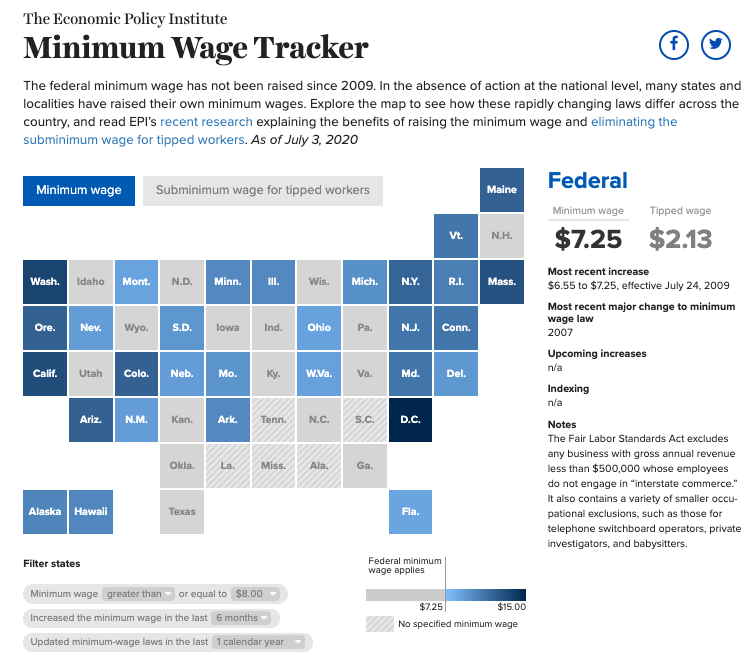

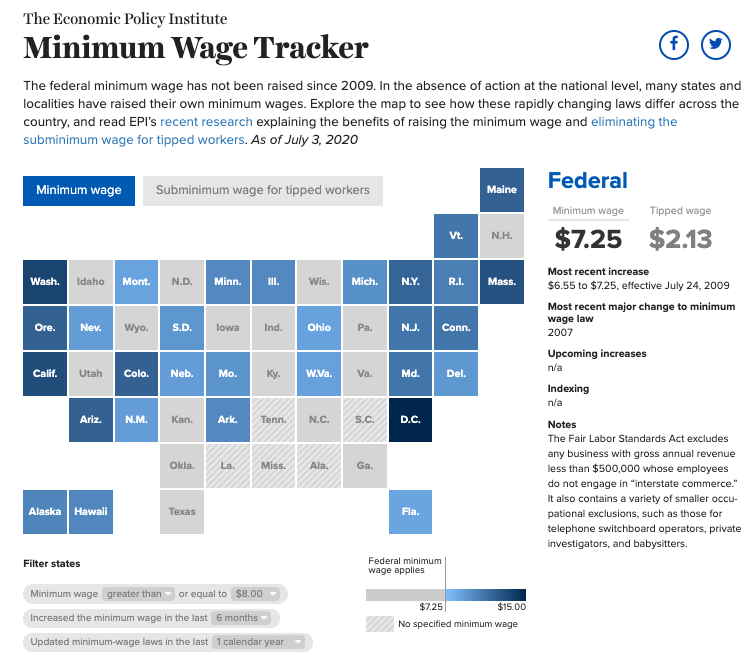

Minimum Wage Tracker Economic Policy Institute

Lawmakers Push For 5 1 2023 Federal Pay Raise Fedsmith Com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Calculator And Estimator For 2023 Returns W 4 During 2022